The Lviv IT Cluster team presented the findings of IT Research Ukraine 2025: From Adaptation to Transformation. This is the only detailed, comprehensive study of Ukraine’s tech industry during the war. The report highlights key market trends, company and specialist perspectives, and outlines forecasts for the upcoming year.

IT Research Ukraine 2025 addresses the key questions of the tech industry:

“We systematically study Ukraine’s tech industry because high-quality data allows both business and the state to act confidently even in times of uncertainty. IT Research Ukraine 2025 continues this mission — it is a comprehensive analysis of the state of the market, the impact of the war, specialist outlooks, and company strategies. Our goal is not only to outline the changes but to demonstrate how the industry can adapt and grow. This research will become a practical tool for decision-making that will define the development of Ukraine’s tech sector,” says Stepan Veselovskyi.

For the fourth consecutive year, the IT Research Ukraine project is supported by the Ministry of Digital Transformation of Ukraine.

“For us at the Ministry of Digital Transformation, it is crucial to understand the real perspectives of companies and specialists, as well as the challenges and growth opportunities they see. The key distinction of the IT Research Ukraine study is its comprehensive approach to data collection and analysis, which makes its results highly representative. They provide us with an end-to-end view of the industry’s current state. I am grateful to the Lviv IT Cluster for its systematic analytics, which enables the government to calibrate support and development policies for the entire industry,” says Mykhailo Fedorov, First Deputy Prime Minister of Ukraine — Minister of Digital Transformation of Ukraine.

Dynamics of the tech sector: stabilization despite challenges

Despite the challenges of full-scale war, the tech industry remains one of the key sectors of the Ukrainian economy, providing significant foreign currency inflows. The tech sector is the largest exporter of services in Ukraine:

In 2024, the sector’s turnover reached $7.48 billion, and exports — $6.45 billion. Even amid global economic headwinds and wartime pressures, the domestic market continued to expand, achieving 1–2% nominal growth and demonstrating remarkably stable demand.

The forecast for the 2025 financial results suggests potential stabilization:

The share of tech industry in Ukraine’s GDP decreased from 4.43% in 2023 to 3.92% in 2024. This relative decline occurred due to the increasing contribution of the military-industrial complex (MIC), manufacturing, construction, and energy sectors to Ukraine’s GDP, driven by reconstruction programs and military contracts fulfillment, while the tech sector maintained a relatively stable level of nominal volumes in 2024. Under favorable business conditions and increased involvement of companies in dual-use and defense solutions, it may return to 4–4.2% in 2026.

By hiring one tech specialist, companies create and sustain 2.7 jobs*. Overall, the industry generated around 644–645 thousand direct and indirect jobs.

*An indicator demonstrating the indirect interdependence of jobs in adjacent industries through the lens of consumer spending dynamics by those employed in tech sector within a year after creating one tech specialist job.

Transformation of companies, the talent market, and mobility

There are currently 2,062 active verified tech companies in Ukraine. The market structure is as follows:

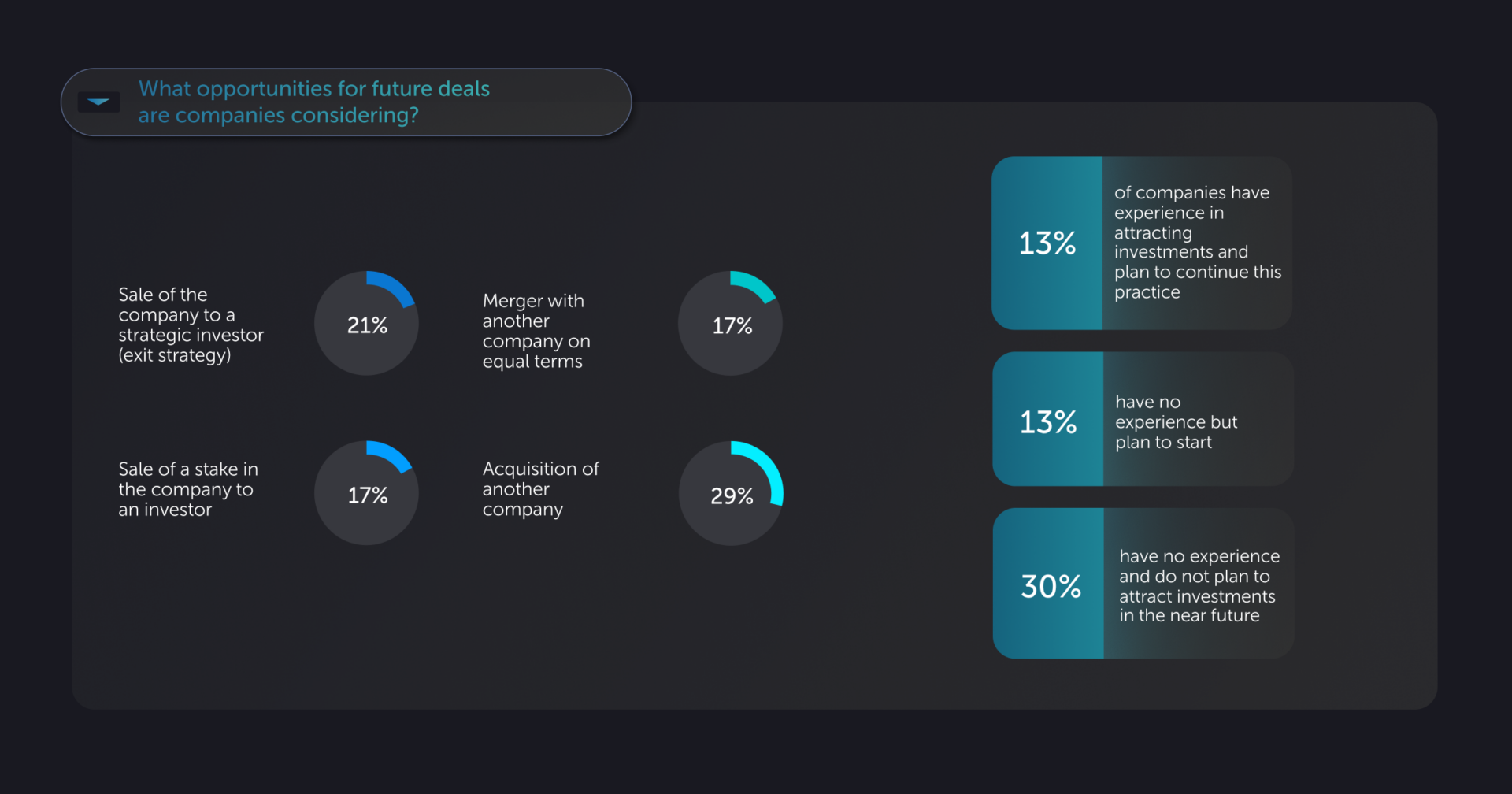

Most Ukrainian tech companies have stabilized after the challenges of recent years and are actively seeking paths for further growth. 13% of companies have experience attracting investment and plan to continue; another 13% — have not worked with investors before but plan to start; 30% — have no experience and do not plan to raise funding soon.

Regarding corporate deals and development strategies, companies are considering:

Awareness among tech specialists about Diia.City — Ukraine’s unique legal and tax framework for technology businesses — continues to grow. Today, Diia.City has 3,095 resident companies and over 130,000 specialists working for them. According to the research findings, 9 out of 10 tech professionals are familiar with this project.

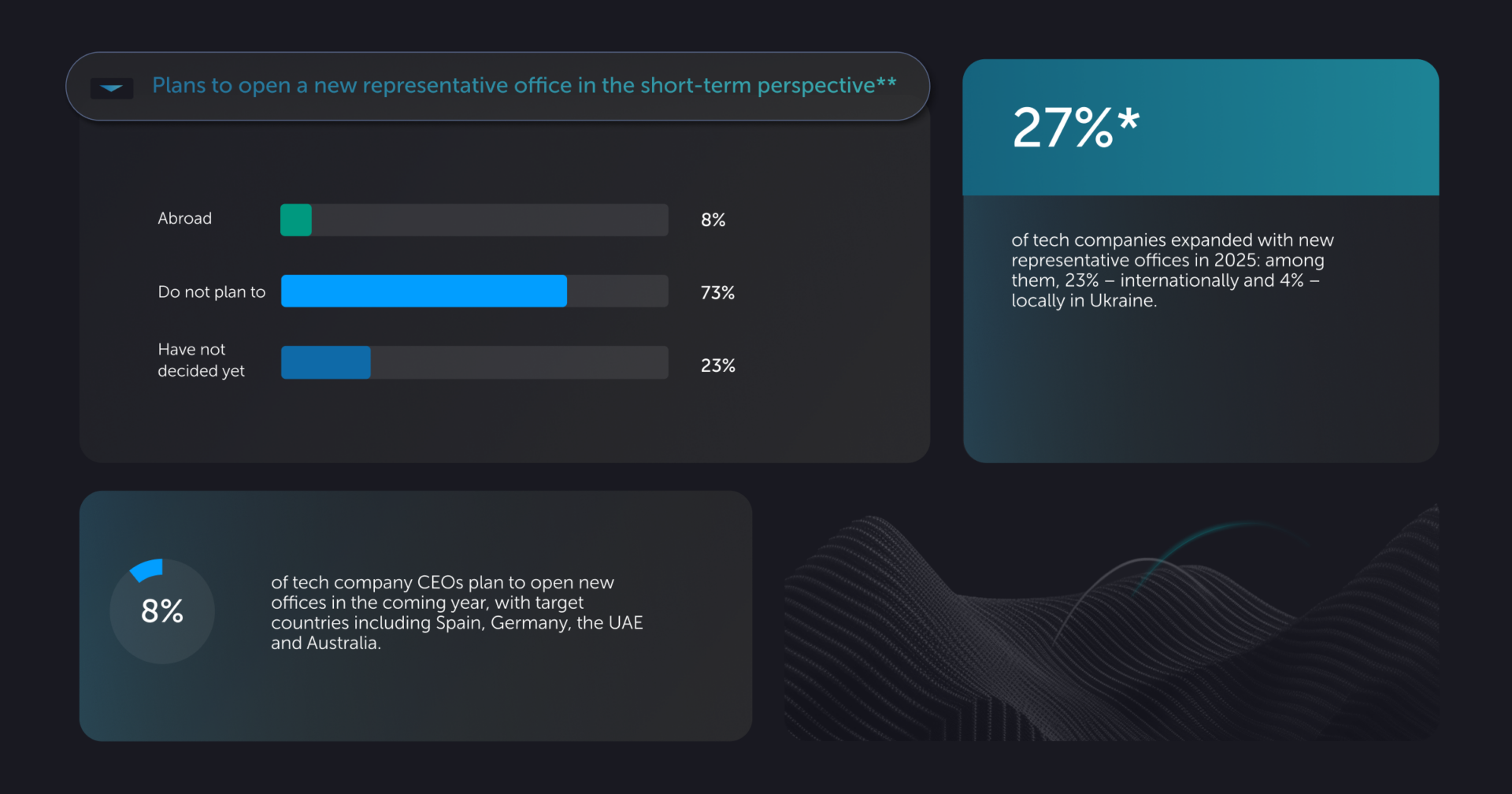

27% of tech companies expanded with new representative offices in 2025: among them, 23% — internationally and 4% — locally in Ukraine. 8% of tech company CEOs plan to open new offices in the coming year, with target countries including Spain, Germany, the UAE and Australia.

The tech industry continues contributing to Ukraine’s victory in the full-scale war. 75% of surveyed companies have mobilized specialists on staff; 35% — have veterans. Many companies also support employees currently serving in Ukraine’s Defense Forces by preserving their jobs, providing fixed payments, or partially compensating military remuneration.

As for specialists working in the tech industry, their number remains nearly the same as last year — 303,000 professionals. Among them, 245,000 live and work in Ukraine — 2.9% more than in 2024.

The number of Ukrainian specialists abroad decreased by 10% and now stands at 58,000, compared with 62,000–64,000 last year. Still, the risk of losing human capital remains. The outflow of specialists has been a consistent trend over the past three years, though only a small percentage actively plan to move abroad.

Ukraine has a strong pool of highly qualified tech talent driving the global technology market. Among technical specialists, 43% have 6–15 years of experience, and 12% — more than 15 years. Over 88% of the entire technical talent pool are Middle, Senior, and Lead specialists.

Half of those employed in the tech sphere have completed or are completing a technical degree related to computer science; over a quarter — a technical degree not related to computer science. Around 5% of tech professionals possess two or more specialties.

Portrait of tech specialist: incomes and savings slightly decreased, while expenses increased

In Ukraine, most tech specialists — over half — are aged 31+. The average age continues to rise: the 2023 study recorded 30.9 years, 2024 — 31.5, and in 2025 — 32.8.

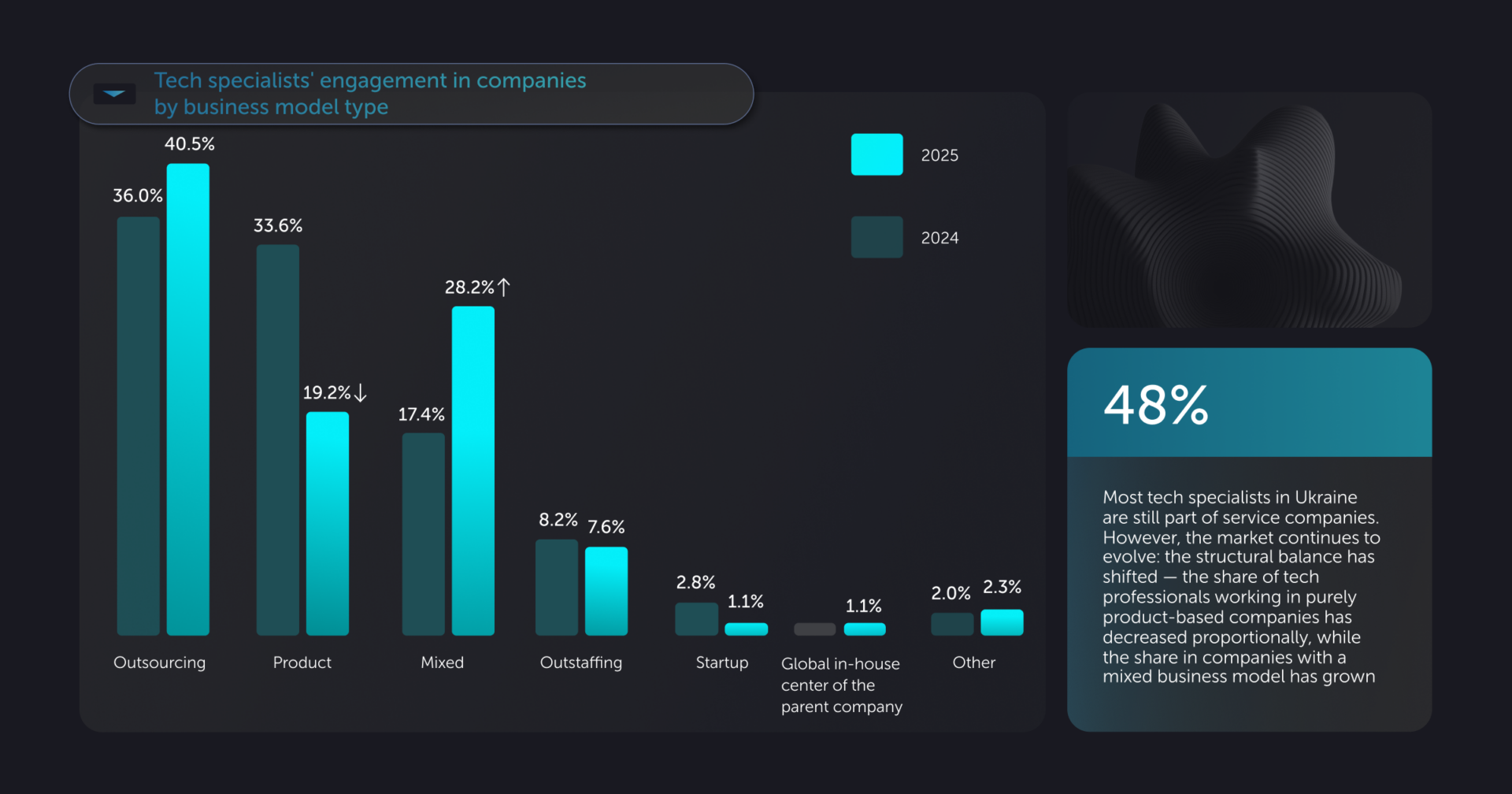

The majority — 48% of Ukrainian tech specialists — are still working in service companies. However, the market continues to shift: the share of specialists working in product companies declined relatively — from 33.6% to 19.2%, while those in mixed-model companies increased — from 17.4% to 28.2%.

The median income of a tech specialist in Ukraine, according to IT Research Ukraine 2025, increased by 4.2% compared to 2024 and now totals $2,700. At the same time, most respondents reported that their expenses have grown: 82.9% in 2025 versus 75.6% last year.

78.6% of tech specialists are able to save money. In 2025, they save an average of 20% of their income. This indicator continues to decline: it was 23% in 2024 and 26% in 2023. Meanwhile, every tenth specialist still manages to save more than half of their monthly earnings. The largest share of spending goes to basic needs — rent, food, etc.

90% of tech specialists donate part of their budget to charity. Among them, 4.3% donate more than a quarter of their income. The average monthly charitable contribution of one tech specialist increased to $243, compared to $235 last year.

Read more about the most important trends of Ukraine’s IT industry in the fourth year of the full-scale war in the IT Research Ukraine 2025 report: From Adaptation to Transformation. Download the report at the link.

IT Research Ukraine 2025: From Adaptation to Transformation was implemented by the Lviv IT Cluster team with the support of the Ministry of Digital Transformation of Ukraine.

The research was conducted within the IT Research project, which has been thoroughly studying and analyzing Ukraine’s tech sector since 2015. Explore the research portfolio at the link.

The data from prior market monitoring and its structural understanding were used for sample weighting to optimize representativeness. With indicators close to 50% and a confidence probability of 0.954, the theoretical margin of error does not exceed 3.5%. The sociological and economic analysis, as well as data verification, were provided by Fama Research Agency, at the request of Lviv IT Cluster.

The study did not include territories temporarily occupied by russia or areas with active hostilities.

The Lviv IT Cluster team presented the findings of IT Research Ukraine 2025: From Adaptation to Transformation. This is the only detailed, comprehensive study of Ukraine’s tech industry during the war. The report highlights key market trends, company and specialist perspectives, and outlines forecasts for the upcoming year. IT Research Ukraine 2025 addresses the key […]

https://itcluster.lviv.ua/wp-content/uploads/2025/12/baner-angl.png